The troubles of Kraft Heinz have been well-documented in recent weeks, following the announcement of a $12.6 billion loss for 2018. This included a $15 billion write-down in the value of its Kraft and Oscar Mayer brands. The shares fell 28% on the news, wiping $17 billion off the company’s market value.

Most commentary blamed an excessive focus on cost-cutting for the company’s problems. But is simply spending more money enough for Kraft Heinz to get back to growth?

What went wrong?

Kraft Heinz was created in 2015 by 3G Capital, a Brazilian multi-billion dollar private equity firm, in partnership with Warren Buffet’s Berkshire Hathaway. 3G bought Kraft, merged it with the Heinz company it already owned and then floated the combined business.

Initially Wall Street admired, and competitors feared, 3G’s ruthless cost cutting. Headcount was slashed by 7,000, equal to c.15% of the workforce and factories were closed. Operating margins were improved to industry-leading levels of 25%+. And zero-based budgeting’ squeezed marketing budgets, so that advertising spend in 2017 ($629 million) was 39% below what Kraft and Heinz spent in 2014, the year before the merger.

However, cost cutting came at the cost of topline growth, with organic net sales falling in nine out of the 12 quarters following the merger. “Critics have long contended that (the) cost-cutting went too far and came at the expense of growth. They turned out to be right. You can’t cost-cut your way to growth,” observed Avi Dan in a Forbes article.

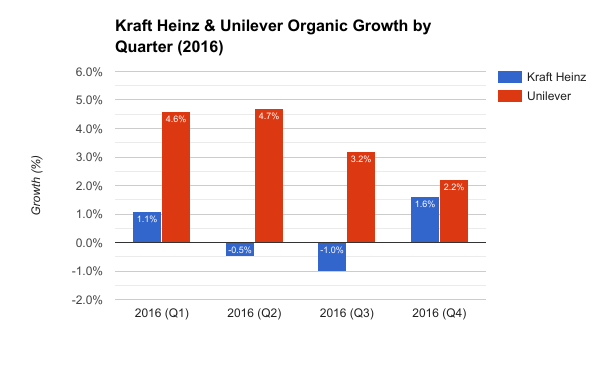

In September 2017 Kraft Heinz tried but failed to take over Unilever, attracted by their stronger organic revenue growth (see below) and lower operating margins of c.15%.

The verdict of the stock market has been brutal since the failed bid to buy Unilever, as shown below by the relative share price performance of the two companies: Unilever (the upper line) up 10%, versus Kraft Heinz down by 65%.

How to bounce back 1 – investing in brands

For Kraft Heinz to bounce back, a fundamental issue does seems to be investment in brand building. The company’s European head, Rafael Oliveira, appears to be thinking along these lines. “We’re not all about cost-cutting. We like to save money that we can then spend on our brands and our people,” he said in a recent interview.

However, implementing this ‘save AND spend’ approach requires a shift in strategy. Up to now, the policy has been to cut spending across the board, including on marketing, as we detailed above. As a result, Kraft Heinz spends c.2% of sales on advertising and marketing and 1% on R&D, compared to FMCG sector averages of c.5% and c.3% respectively, according to Guggenheim Securities.

How to bounce back 2 – big brand rejuvenation

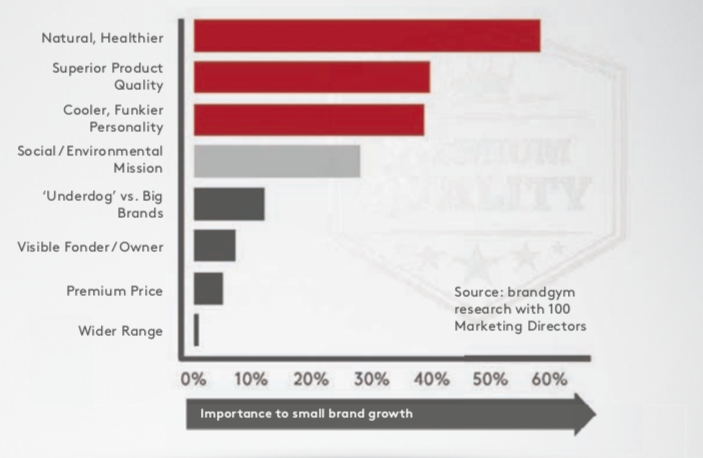

Investing more may help but is not enough. I suggest the bigger challenge for Kraft Heinz is to rejuvenate its big brands, which are under attack from smaller ‘insurgent’ brands and also from private label. In particular, big brands like those of Kraft Heinz portfolio need to improve perceptions of naturalness and product quality, as shown by the research we published last year.

Here, Kraft Heinz has a big mountain to climb, as several of the company’s key brands are seen as being processed, high in sugar and low on nutrition. An example is the Jell-O desert brand, which has suffered a sales drop of 26% between 2013 and 2018, worse than the category decline of 22%.

I’m not clear on the strategy of Kraft Heinz in terms of improving naturalness and authenticity. The company’s innovation accelerator, Springboard, is using the right, on-trend attributes to select start-up brands to invest in: naturalness, craft, health and experiences.

However, I question whether these drivers are being used widely and quickly enough on the big brands the company really needs to rejuvenate to drive growth, as shown by the following examples:

- Oscar Mayer: the brand did remove added nitrates and nitrites from its hot dogs, as well as artificial preservatives. However, this move in 2017 was two years after the World Health Organization said there was “sufficient evidence” that eating processed meat causes colorectal cancer.

- Jell-O: last year’s launch of Unicorn Slime might have added play value, but did the day-glo packaging and product form help improve naturalness and health credentials?

- Capri Sun: the brand was forced to remove an ‘all natural’ label in 2017 after being sued for mislabelling, with the company’s VP for Corporate and Legal Affairs reported as saying, “You might as well be feeding your kids a Coke.” Today the brand is again making the ‘all natural claim’, following a reformulation.

- Max Boost coffee from Maxwell House: focuses on offering extra caffeine (x1.25, x1.5, x1.75), which provides energy but doesn’t seem particularly healthy? In addition, it looks like a new brand with limited link back to the Maxwell House brand.

- Devour: the frozen food brand invested heavily in Super Bowl ads using the idea of ‘food porn’ to promote calorie-heavy concoctions, showing a young man hooked after ogling ‘steamy’ online images. Kraft Heinz even took out ads on an actual porn website as part of the campaign. Edgy yes. Natural, authentic, healthy and crafted …. not so sure?

How to bounce back 3 – divesting and buying brands

Although 3G is famous for its mega-deals, maybe a change in strategy is needed to accelerate growth at Kraft Heinz.

First, they could sell off brands where it believes the challenge of generating growth is simply too big. The company is reviewing options for the Maxwell House coffee business, including a sale, according to CNBC .

Kraft Heinz could also consider a more targeted approach to acquisition to fill gaps in its portfolio relating to channels, consumer trends and geography. This is the approach used by Unilever as we posted on here. They bought 18 businesses between 2015 and 2017 for a total of €8.8bill with an average purchase price of €500m compared to $100bill for the acquisition of SAB Miller by 3G’s Ab InBev. Kraft Heinz has started to explore this route, buying ‘paleo’ condiment and dressing company Primal Kitchen early in 2019 for a reported $200mill.

How to bounce back 4 – inspiration from Europe?

Perhaps Kraft Heinz could learn from the relative success of its European business, which increased organic sales by +3% in 2018, compared to a -1% drop in the main US business. Quoting again the European leader, Rafael Oliveira, “We’ve been growing for two years in a row, something that hadn’t happened for more than a decade.”

Regarding the brand investment question, marketing spending and investment in innovation is “higher than ever”. And in terms of brand renovation, the European company has also made some smart moves.

- The recent launch of microwaveable Heinz soup pots brings convenience and modernity to a big, established brand. This builds on the success of Heinz Beanz microwaveable ‘Snap Pots’, which achieved £10mill of sales in their first year and helped drive value growth of +11%, according to Asmita Singh, senior brand manager for Heinz Soup.

- On the health side, sugar levels in Heinz ketchup and baked beans have been “dramatically reduced”

- The 2016 brand stretch of Heinz into mayonnaise has promising early results, achieving an 19% value share, increasing value sales +98% vs YA and contributing 87% of recent category growth.

In conclusion, the Kraft Heinz story shows the risks of cutting marketing investment at a time when big brands are under attack from both insurgents and private label. It also demonstrates the need for brands to have a clear strategy and action plan to constantly renovate themselves.

In Kraft Heinz’s favour, they do have a stable of famous brands, and senior management says they are committed to investing more in marketing and brand building. Given a share price/earnings ratio (P/E) of only 9, compared to c.14 for Unilever and General Mills, maybe it’s time for brave investors to buy Kraft Heinz?!

This piece is by David Taylor, Founder & Group Managing Partner at the brandgym and first appeared on the brandgym's website here.

Newsletter

Enjoy this? Get more.

Our monthly newsletter, The Edit, curates the very best of our latest content including articles, podcasts, video.

Become a member

Not a member yet?

Now it's time for you and your team to get involved. Get access to world-class events, exclusive publications, professional development, partner discounts and the chance to grow your network.