What an eventful start to a new year. Many predictions may already be outdated as major happenings alter the way things were anticipated.

Widely gyrating financial markets reflect the rollercoaster path the global economy is currently taking.

Europe has been at the centre of news flow. Widespread outrage at brutal acts of terrorism in Paris has been followed by disorderly currency markets as the Swiss currency prop to the euro was withdrawn, followed by the announcement by the European Central Bank of quantitative easing (QE, aka printing money) and the Greek general election result.

Many thought leadership messages have been transmitted from the World Economic Forum at Davos with inequality and philanthropy popular themes.

Increasingly central banks, needing to boost economies and consumer well-being through QE, stand accused of aiding and abetting asset price bubbles – in shares and in property – and increasing inequality. At the same time global competition across many sectors is keeping wages in check.

In the UK, the onset of the general election campaign is set to reach fever pitch. The impact of austerity, the cost of living and who is best to manage Britain’s deficit reduction programme are major policy divides.

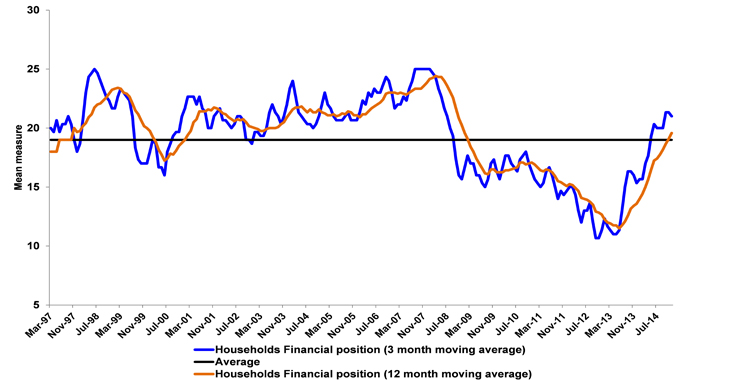

The evidence from JGFR / GfK data is that consumer confidence has rebounded very strongly over the past two years, with consumer spending increasingly boosting growth, as household finances have improved to their strongest since June 2008.

Source: GfK NOP/ European Commission/ JGFR

With a unique mix of ultra-low interest rates, slumping oil prices, record numbers in work, and improving earnings the UK consumer has rarely been in such an economically benign time. Median inflation expectations are around zero.

Across nearly all segments the good times have returned. Compared to March-May 2010 in the run up to the last general election, consumers’ household finances in the past 3 months (source GfK NOP/ European Commission) are 4 points better (+21 v + 17). While people at both ends of the income scale feel worse off, in the lowest income band by 1 point to-4 and in the top earnings band (£50,000+) by 3 points to +43, the gap between top and bottom household income band has narrowed slightly since 2010. People in the middle income band (£25,000-£34,999) show most improvement in household finances, up 6 points to +25.

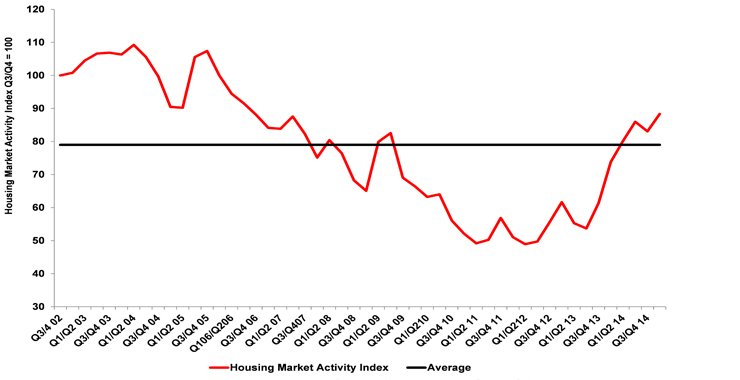

December retail sales were much stronger than economists expected; the JGFR Q1 Financial Activity Barometer measures of savings, investment and borrowing were well above average with property and car finance purchase intentions at multi-year highs. A pre-election boom seems increasingly likely (off the radar events not intervening).

Stamp duty changes announced in the Autumn Statement should result in considerable pre-election activity, although mortgage demand is unlikely to be satisfied with far fewer lenders and more restricted practices than in the past as regulation bites. Demand among Londoners is especially strong, with many likely to on their way to find property outside of the capital.

Combined mortgage and property purchase intentions 2002-15

Source: GfK NOP / JGFR

Last year financial services was never far from the news as growing numbers of challenger organisations announced plans to enter the industry, many moving into the online space bringing together borrowers, savers and investors. Others were seeking to enter the banking business with digital banking at the centre of offerings.

For the latter especially, the big issue is whether people will fall out of love with digital as trust in privacy and security continues to offset gains in timeliness and ease of access. This is a concern for all investing in digital as the way forward.

Results from the latest JGFR /GfK Banking Barometer shows that the Top 10 high street banks have taken a firmer grip in the main bank space with a record 90% share. Overall a record 93% of consumers have a main bank/ main financial services provider. Indeed far more young people are now visiting branches probably to make sure they are known as potential mortgage customers.

Inequality will be a constant theme in the coming months with ongoing discussions about how to narrow the gap. Both the gender and generational gaps will come under scrutiny as politics trumps economics in a year that will change many lives.

Across Europe some 7 general elections are to take place with many new nationalist parties emerging with growing public support. The Greek election result will increase anti-austerity sentiment despite deficit-cutting policies beginning to work.

For the Chinese, 2015 is the Year of the Goat – associated with calm. For many countries across the world it seems more likely to be the opposite – turbulence – the Year of the Rollercoaster.

Marketers will need to track consumers’ mood changes to both economics and politics and target ‘safer’, traditional segments.

Best wishes for 2015 or as from February 19 in Chinese; Kung hei fat choy!

Read more from John in our Library.