Recently, Accenture announced its acquisition of Karmarama, one of the UK’s largest independent advertising agencies. Doubtless there was much hand-wringing in some quarters of the advertising community about the continuance of ‘the Mad Men being over-run by the Maths Men and Women,’ but the writing was probably on the wall a while back when Accenture signed on as a sponsor of the Cannes Lions International Festival of Creativity.

This isn’t Accenture’s first acquisition of a creative business… in 2013 it bought Fjord (a digital design firm) and integrated it into its Accenture Interactive offering. It has built up a portfolio of digital agencies and creative technology firms around the world, after buying Media Audits back in 2005.

Meanwhile, McKinsey acquired Lunar, and more recently, Veryday (both are design firms), CapGemini bought Fahrenheit 212 (an innovation consultancy), BCG bought BrightHouse (ditto) and built up its Digital Ventures arm, Deloitte bought Heat (a digital agency), and IBM bought Resource/Ammirati (ditto).

In parallel, the leading brand consultancies like Interbrand, Siegel & Gale, Wolff Olins, Landor, FITCH, The Brand Union, FutureBrand, Lippincott and Prophet have been adding digital capabilities, while digital innovation firms like frog, Method and Designit have been adding brand strategy capabilities.

All this while, advertising agencies have invested heavily in programmatic media and social media capabilities and talent, CRM capabilities, brought on board creative technologists, search specialists and data scientists, and are generally doing all they can to try and cope with the tsunami of digitally-driven change which threatens to overwhelm them, even as their margins erode. Some are succeeding – OgilvyRED offers consulting across brand strategy, digital transformation and more, and R/GA has moved beyond digital communications to product development and experience design.

So what’s really going on across the wider professional services sector, and why?

C = D + D + D

To use a much-maligned, already over-used yet unavoidable word, convergence… driven by the heightened importance of the 3Ds: Design, Digitisation and Data.

As people increasingly value and consume experiences, businesses have found that investments in experience enhancement generate far better returns than investments in communications. Every smart consumer-facing business now has an app (sometimes several) and/or a content-rich, commerce-capable website, and every e-commerce player and B2B business has to invest in making their website compelling, intuitive and frictionless.

On the strength of its ability to impact business performance, design (with a ‘big D’) has claimed its rightful place in C-suite discourse. Experience design is now the definitive area of practice for strategists and designers, it is increasingly mobile-first with digital at its core, and the ongoing platformisation of physical businesses will continue to cement the centrality of its importance. Businesses like Apple, Facebook, Google and Uber have established excellent in-house design studios and IBM, in addition to its formidable technology, consulting, cloud, data and analytics competencies, has a significant market-facing digital design offering. And experience innovations like Disney’s MagicBand (a physical product augmented with a technology- plus-data back-end to significantly enhance customer experience) have measurably beneficial business impact, whilst raising people’s expectations of experience delivery in our connected age.

Meanwhile communications too are increasingly digital in nature, consumed more often than not on smartphones and social media platforms, with increasing interactivity. And they’re being targeted digitally with continually calibrated and increasingly sophisticated programmatic media algorithms.

All of this is happening against the backdrop of the smarter businesses’ better ability to collect and analyse real-time data across communications effectiveness, content consumption and commercial performance, and use that knowledge to deliver more tailored offerings and drive greater customer satisfaction, higher brand preference and better business results.

Overall, we're at a point where the old communications creative development process based on an insight-based communications strategy and a consequently singular creative point of view is yielding to an iterative, digital-centred, multi-touchpoint customer journey based experience design process informed by data about the marketplace performance of each component of the end-to-end customer journey... of which communications is merely an aspect.

A key outcome of this shift is the blurring of traditional lines between historically distinct areas of professional practice, and in our slow-growth world, professional services firms are strategically smart to cover a wider spectrum of inter-related client needs, not just restrict themselves to some parts. Ergo, we should expect continued cross-sector acquisitions and/or competence enhancement, to serve the twin interests of greater client-need coverage and wider revenue and profit pools.

Why are the management consultancies and the Big Four firms in this space?

For management consultancies, Operations work (implementation, enhancement, optimisation, etc.) has constituted a greater share of their global revenues than Strategy work for some time now. According to Statista, their share of global Strategy revenue has risen from 26.5% to 30.5% over 2011-2016, while the global share of Operations revenue is up from 55.5% to 71.2% over the same period. Much of this growing operational consulting work is now in the digital space as businesses grapple with digital transformation imperatives, so there’s the strategic logic underpinning consulting firms’ acquisitions of digital and creative agencies.

In recent years, global annual revenue growth in the accounting, tax and audit advisory sector (which the Big Four define) has risen from the 2-3% to the 5-6% range (similar to management consulting), post the completion of Sarbanes-Oxley reforms as the accounting firms are once again able to offer consulting services… resulting in PwC buying Booz & Co. (now Strategy&), Deloitte buying Monitor, and KPMG and EY bolstering their strategy and operations consulting capabilities.

In a slow-growth world it is prudent, perhaps even attractive for firms in both sectors to set up additional lines of business by acquiring creative/design/digital firms to widen their operational consulting offerings. Deloitte Digital is now one of the world’s largest digital agencies, as is Accenture Interactive; both offer a wide array of consulting and creative services.

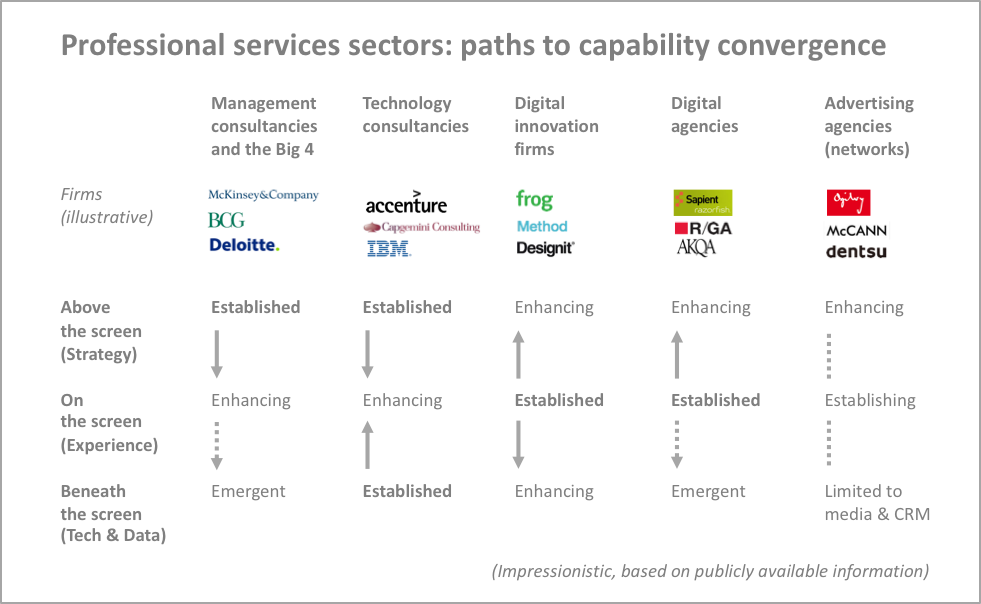

An interesting metaphorical way to parse the professional services needs of businesses in today’s mobile-first, experience-centred, data-driven world is by taking a 3-layered view wherein ‘above the screen’ = digital strategy, ‘on the screen’ = digital design and experience, and ‘beneath the screen’ = technology and data. Here’s how the sectors and firms in this increasingly converging space are shaping in terms of capabilities…

As evident from recent and current developments, this is an increasingly crowded space, it is also in flux, and over time the quality imperative and the laws of economics will prevail.

The large global advertising agency networks are perhaps the most challenged segment of this converging macro-sector, lacking heft in ‘hard’ technology capability and yet nascent or evolving in terms of capabilities in the digital transformation strategy area. Their forte continues to be the development of engaging and persuasive creative content, and that too is beginning to come under threat from progressive media content companies like VICE and Vayner. However, their holding company parents have hedged their bets with digital acquisitions and increasing inter-firm consolidation for scale, viz. WPP’s Possible, and recently Sapient Nitro + Razorfish at Publicis Groupe.

What could the future look like?

It's time to indulge in some speculation (whilst reserving the right to be proven wrong in time).

The technology consultancies may well be best placed to prevail in the long run because of their combination of scale and their tech & data smarts, coupled with deep pockets; Accenture and IBM certainly seem to be setting themselves up for long-term success.

The management consultancies and the Big Four firms won’t be too far behind, perhaps evenly poised, even… they will mostly likely continue acquiring digital design firms/agencies and talent, and might find it somewhat easier than their technology consulting rivals to optimally monetise their efforts by virtue of the deep and wide corporate clientele and C-suite relationships they already enjoy.

The digital innovation firms will most likely be acquired by the management consulting or Big Four accounting firms (at rather good multiples), or acquired by the large communications holding company groups and merged with their brand consultancies. Some may choose to stay independent, though... but for how long?

The really good digital agencies will probably transform themselves into digital innovation firms, and R/GA seems to be heading firmly in this direction.

Advertising agencies will probably continue to be challenged in these circumstances, with mixed fates. The good and increasingly digital independents will probably continue to be acquired (Karmarama may well be the first of many), but the massive global network agencies will face the dinosaurs’ dilemma – evolve or die – even as they are assured some continuity by virtue of their incumbency, revenues and relationships. Some of them are evolving better and faster than others and will probably make it, helped perhaps by their holding companies buying up sub-scale management consultancies and merging them in, whilst adding in some of their currently-owned digital agencies to create a compelling and competitive end-to-end offer. Purely as a hypothetical example, we could possibly see a JWT+ADLittle+AKQA–type entity sooner rather than later.

And what of brand consulting, the sector in which I’ve been a practitioner and a client over the last decade, post two decades in advertising? The good brand consulting firms are investing in enhancing their digital capabilities and, in addition to their traditional brand strategy, analytics and design offerings, are now playing in the area of connected omni-channel brand experience design. Experience innovation is probably their way forward, and they will build and/or buy their way into digitally-driven evolution, or face the same choice as advertising agencies. Meanwhile it is quite conceivable that the Big Four firms could set up brand audit and governance offerings as organic extensions of their legacy capabilities, then parlay them into brand strategy and experience design offerings.

What we know for certain is that the evolution of professional services firms will continue playing out along its relentless arc, as it always has; it is nature’s way and business ecosystems are no exception. It will also be good to see new forms of firms emerge, with new business/revenue/compensation models and cultures. Overall, it continues to be an extremely interesting time to be alive and practicing!

This piece, by Ash Banerjee, Board Member of The Marketing Society Middle East first appeared on LinkedIn here.