The CEO of BBDO, John Osborn, recently described his vision for the future of the agency as ‘better, faster and cheaper’, because this is what clients are asking for. This upgrades the agency’s creative philosophy that CCO David Lubars had been using for a few years, which was ‘good, fast and cheap’.

These statements are a reference to the classic project management trilemma, where you are given the options of ‘fast, good, or cheap’ and you pick two. The reason you have to pick two is because they act as limiting constraints on each other.

The three properties are interrelated and it is impossible to optimize all three: one will inevitably suffer.

It is not clear how BBDO has managed to solve this famously intractable problem - beyond just saying it — but if true then BBDO employees seem likely to have longer hours and less raises to look forward to for the foreseeable future.

Regardless, we do live in a world where clients are looking to depress the fees they pay, produce a higher quantity of effective work, and do it at the speed we used to call ‘real-time marketing’.

Kia’s Dave Schoonover recently suggested that “brands can do some things faster than agencies can”.

No doubt the world has moved on since the glacial pace of advertising agencies in years past, when producing a television commercial could take six months to a year from brief to completion. Before the internet, the high latency of analogue communication set parameters on the speed of collaboration.

The size and meetings culture of agencies are another factor. When I was on the board of one of the largest advertising agencies in New York, I would be booked, double-booked and triple booked into meetings all day. That meant it would take an average of three weeks to get into my calendar. (I’m told this isn’t unusual.)

Conversely, as the agile nomadic consulting business that we are now, we pitched against one of the largest brand consultancies in the world last year and won the brand strategy piece in part because our timeline to complete the research and strategic development was three weeks, entirely at the client’s office, instead of over the course of several months with other clients to work around, account teams to manage the process, and various other layers of costs.

One way that brands can do things faster than agencies is to pull some outsourced functions back in. This is why we have long predicted that social media activities will be reabsorbed, especially since Twitter is primarily a customer service channel, or should be.

Other agency functions have begun to metastasize inside the body corporate:

Verizon recently hired Andrew McKechnie from Apple’s in-house agency to be its first chief creative officer.

More than 2,000 former employees of WPP now work for Google or Facebook at their in-house shops.

Mobile operator Sprint created an internal studio called Yellow Fan, which assumed responsibility for film and print production, but is being referred to as a“full-service advertising and marketing agency.”

Unilever is looking to save $2bn with its in-house U-Studios and U-Entertainment and is halving the number of agencies it works with globally.

In a parallel move, one way in which agencies can increase their speed and lower costs without hitting their margins has been to vertically integrate, building internal production operations themselves.

Traditionally, creative agencies charge a percentage mark-up on production as an additional fee to cover the cost of selecting, negotiating with, and managing the partners, despite the fact that they are charging retainers based on the presumed FTE allocation to do so. (This also creates a perverse incentive to select the most expensive production options or to seek higher budgets.)

Setting up their own production facilities pits agencies into competition with those production companies. It creates the conditions for a conflict of interest since the agencies maintain relationships with advertisers, offer production services and, as agents, are tasked with selecting other production providers.

At the end of 2016, the US Department of Justice opened an investigation into exactly that. It has subpoenaed all the major holding companies to explore whether they used that position to price-fix the bidding process. The investigation is ongoing. There’s a lot at stake and not just the $5 billion market (in the US alone) for production and post-production.

To be agents, we must have clients’ trust. This is a scandal analogous to the ongoing one over rebates and transparency (or lack thereof) in the digital media supply chain. An ANA study after this came to light indicated 31% of marketers have expanded their in-house media buying capabilities.

The CMO of Fiat Chrysler recently suggested that even if clients aren’t building their own production facilities, they are taking control of that process:

“What you may hear from our agencies is that they do not have control on the production process anymore. We created a roster of production companies as we have a roster of agencies, and then we will directly source productions centrally.”

The tricky thing about promising good, fast AND cheap, is that you only have to prove one of them upfront. WPP thinks this is depressing revenues across the entire sector.

Upon reporting disappointing first half 2017 results, triggering an 11% slide in their share price they said that competition was “fierce” and that

“There have been several examples recently of major groups being prepared to offer clients up-front discounts as an inducement to renew contracts, heavily reduced creative and media fees, extended payment terms (which are starting to show up on agency balance sheets), unlimited indirect liability for intellectual property liability and cash or pricing guarantees for media purchasing commitments, even though the latter are difficult for procurement departments to measure and monitor.

“As some say, you are only as strong as your weakest competitor. These practices cannot last and will only result eventually in poor financial performance and further consolidation, the premium being on long-term profitable growth. Our industry may be in danger of losing the plot.”

Eagerness to get business in the door drives agencies to negotiate in various ways upfront as clients seek to reduce their spend on “non-working media”. This puts incredible pressure on the people doing the work down the line.

Beyond longer hours and burnt out staff, it drives agencies to look for margin in other ways, be it media rebates, production services, or opaque programmatic media buying costs.

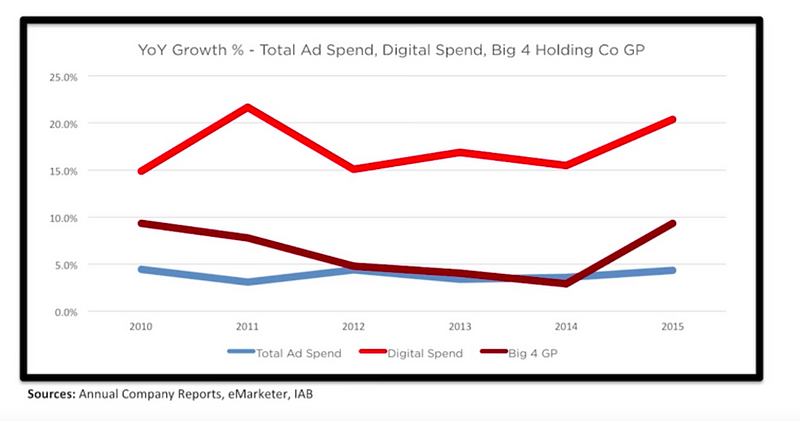

Ivan Pollard, CMO of General Mills, recently spoke at WFA Global Marketers Week, where he pointed out that holding companies profits seem to rise of late in lock step with programmatic revenues, which “does causes us to raise an eyebrow”.

Having some visibility into holding companies from previous jobs, I can validate that the trading desks were the most profitable parts of the network, by some margin, which also would seem to create perverse incentives to drive ever increasing amounts into programmatic, especially private “darkpools”. This is indeed what has happened, despite all the valid concerns about fraud, bots and adblocking. It’s growth vastly outperforms growth in the market as a whole: Globally, programmatic ad spend grew from $5bn (£4bn) in 2012 to $39bn (£31.3bn) in 2016, at an average rate of 71% a year.

74.5%, or $24.25 billion, of US digital display ad dollars transacted programmatically will go to private marketplaces and programmatic direct setups.

All these practices have dramatically eroded the trust clients have for their agencies, with the cascade of results described above.

So sure, we can continue to promise to somehow be better, faster and cheaper, but famously, trust takes years to build, seconds to break and forever to restore.

This article originally appeared on medium.com