In this article, we look at how behavioural science is helping people tackle their debts.

Credit card debt is a significant problem for a growing number of people in many countries.

For example:

- In the UK, consumer debt is growing at a record rate of 10.9%; average credit card debt per adult has reached £1,300 and total debt now stands at £67.3 billion - higher than even before the 2008 financial crisis. The Financial Conduct Authority has identified 3.3 million people who have what it calls 'persistent levels' of credit card debt. Beyond that, other forms of debt - such as car loans and personal loans have also risen, so that the average household now owes £14,000.

- In Australia, credit card debt is also high. Overall credit card debt reached a record high of $52.2 billion in 2016. The average debt of a credit card holder in Australia is $3,095, with 63% of those card holders accruing interest; the average card balance attracting interest is close to $2000, with Aussies even using credit to pay for basic goods and bills. One survey found that 25% of all credit card spending went on groceries, 16% on utility bills, 16% on general shopping.

- In the US, credit card debt reached $1 trillion in 2016, again, the highest level since the 2008 financial crisis and 6% higher than in 2015. The average household now has over $16,000 of credit card debt. Millennials are also saddled with considerable student debt – the average student debt stands at $34,000, an increase of 70% from 10 years ago and 18% of debtors are already in default.

There is of course, no single explanation for why people end up stuck in a financial swamp. External factors such as rising living costs and reduced benefits/welfare systems are certainly partly to blame. We also know that financial literacy levels are low and this lack of knowledge and confidence can hamper good decision-making.

In addition to these factors, insights from behavioural science have shown how the very way our brains are wired can also lead us into debt. For instance, our tendency to ‘discount the future’ and value gains in the present over gains in the future can make it tempting to spend more than we can afford. Impulsive, ‘hot’ emotional behaviour can accentuate this. Over-optimism about the future can also lead us further into dire straits, believing that tomorrow, we’ll get that pay rise, or win the lottery. Today millennials also often suffer from a type of despondency and inaction related to feeling daunted by the

amount they need to pay off or save to reach a personal financial goal. They stall, ‘rabbits in the headlights’ because they see no point in starting to attempt the goal, or struggle to find the capacity to break up the goal into more manageable sub-goals.

So how are insights from the behavioural sciences being leveraged to help people pay back their debt and keep it under control?

Below we outline three different initiatives:

How behavioural science helps us develop an effective plan to pay back debt

In 2013, a team of US researchers partnered with an anti-poverty agency in Oklahoma, US to run a pilot intervention called 'Borrow Less Tomorrow' to see if they could leverage BE to encourage consumers to pay back their debt.

Over 400 consumers volunteered to take part. The majority were on low incomes, with 75% reporting a total annual household income of less than $30,000. The average individual credit card and auto loan debt of participants was $2,447 and $5,546 respectively. Researchers randomly assigned 238 individuals to receive the intervention, and 227 individuals to the control group.

The intervention was three-fold:

- First, participants were offered the chance to work with agents to develop a repayment plan. Repayments were designed so that they automatically increased and accelerated over time. As the lump sum of debt is paid off, minimum interest payments fall meaning this money can now be used to pay off more debt, snowballing repayments. Making a plan leveraged what behavioural scientists have termed ‘implementation intentions’ - the act of making a specific plan of action, helping people feel committed to making repayments, easing the cognitive burden of working out the nitty gritty details concerning how best to do it and embedding the plan in the memory so that we remember to carry it out.

- Second, participants were given the option to select one or more of their peers to be notified if they fell off-track with their repayments. The peer could then offer encouragement (but not financial support) to help them regain momentum and reach their repayment goal. This leveraged what’s known as injunctive social norms - when we are aware of what we should be doing according to societal attitudes - by creating peer pressure to pay down debt.

- Third, participants received monthly reminders by email and phone to keep repayments front of mind and reduce forgetfulness. We all lead busy lives and it’s easy for things to slip our minds, so using simple reminders prompts us to fulfil our well-meaning intentions.

Of those in the intervention group, 41% signed up for an accelerated repayment plan and after 12 months, 51% were on track with their repayments. And crucially, debt levels were lower than the control group. With the three-point plan of action people paid off their debt faster.

Reframing the cost of payday loans

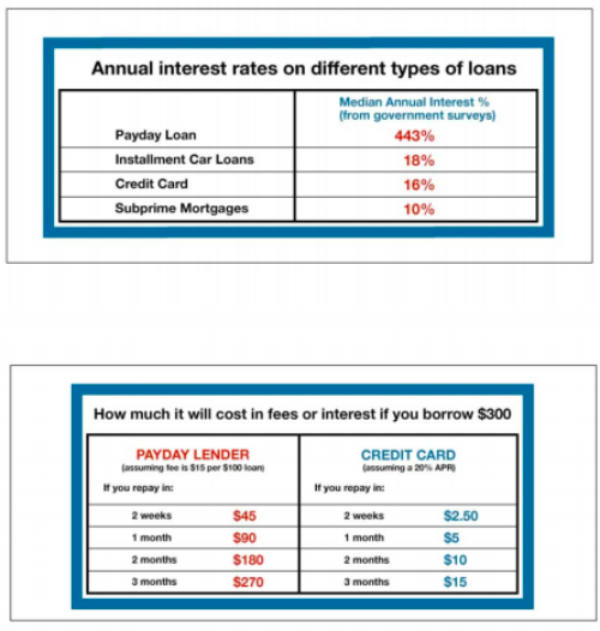

Payday loan companies usually charge phenomenally high interest rates, making them an expensive source of credit. Policy makers and regulators are often concerned that these loans are marketed in ways which pull the wool over consumers’ eyes - using opaque terms and not making important conditions salient or easy to understand. Are consumers always fully aware of the real cost of the loan or are they being duped? And if it is the latter, should regulators act to make information more transparent and easy for the average consumer to understand?

In an attempt to address this issue researchers Marianne Bertrand and Adair Morse looked at whether reframing the cost of the loan impacted whether and how much people borrowed. There is considerable evidence to suggest that people struggle to fully understand what APR means and even if they do, overconfidence about their ability to repay or the pressing need for money today may outweigh any concerns about how the loan will be repaid in the future. Researchers wanted to see if presenting the repayment implications in an alternative, easy-to-understand format would make a difference to demand for loans so they showed consumers how the repayments stacked up over time in actual dollar amounts, thereby enabling potential borrowers to see at a glance how much they would need to repay over time.

Managing somehow(!) to collaborate with one of the largest nationwide payday lenders in the US, they tested framing the cost of a payday loan either:

- in dollar amounts (new frame); or

- using interest rates (old frame)

See image below for the actual graphics used in the intervention.

They found the dollar reframe reduced take-up of payday loans by about 10% in the 4 months after people were exposed to the reframe. And importantly, those with less education responded more to the reframe. This suggests that this type of regulation - about how loan information is disclosed - would have a significant impact on the propensity of people most vulnerable to making a poor decision to take out such loans.

Giving people a simple rule of thumb for using credit

We navigate life using many rules of thumb – simple, easy shortcuts for making quick decisions - yet in the financial world they are few and far between, making managing our money a very confusing and complex endeavour.

An initiative by the Arizona Federal Credit Union in Phoenix tested an idea based on a simple rule of thumb to see if they could help people spend less using credit. First, they identified 14,000 customers who were not paying off their credit card bills. Over a 6-month period, customers received an email, were mailed a fridge magnet or were shown online banners reminding them about a simple financial rule of thumb centred on the observation that numerous small payments quickly add up:

“Don’t swipe the small stuff. Use cash when it’s under $20.”

This heuristic made it easy to decide whether or not to pay for a purchase by credit card. It provided a simple and memorable shortcut which guided people into using their credit card less often, perhaps even helping to make using it less of a habit.

By the end of just 6 months, customers’ average credit card balance was cut by $104 or 2% lower than the control group. This difference kept on growing over subsequent months. Just three months later those exposed to the rule of thumb had a balance $161 lower than the control group. Although this is a relatively small impact, it was a virtually costless intervention and the gains quickly build up over time.

In conclusion:

These are just three examples of how insights from behavioural science are helping people to gain greater control of their finances: how simple rules of thumb, tiny changes in how information is presented, defaulting people into repayment plans and simple reminders can have significant impacts down the line. Behavioural science is often not about big, brash, revolutionary changes which turn existing systems upside down, but more about how to tweak and finetune what is already there to make it work - often astoundingly - better.

Top: The old frame using interest rates to compare the cost of the payday loan

Bottom: The new frame using actual dollar amounts to compare the cost of a payday loan

About this series: An exploration of Behavioural Science in action and how it is transforming lives 24/7

Behavioural economics (BE) is still a buzzword in many sectors, even after breaking into mainstream thinking several years ago. If anything, interest is higher than ever before and it’s rare to find someone who hasn’t come across ‘nudging’, the concept of ‘System 1 and 2’ or Nobel Prize winner Daniel Kahneman.

Over the last few years we have seen and been part of the journey taking behavioural science from the academic world into the real world. Inspired by this science at the outset, multinational corporations, governments and not-for-profit organisations, set to work to try to understand the behaviours of their customers and citizens in order to guide and nudge them towards desired actions, or to improve their experience. It’s an investment that is now coming to fruition. The OECD recently stated that “Behavioural insights can no longer be seen as a fashionable short-term foray by public bodies. They have taken root in many ways across many countries around the world and across a wide range of sectors and policy areas." The impact of behavioural research undertaken yesterday is now evident in the products, services and communications we all encounter or use today. BE is making a significant difference to our everyday lives.

In something of a salute to this, we are running a series of articles over the next 12 months to take our readers on a 360 degree tour of how behavioural science is transforming our lives 24/7; how it is shaping better outcomes for us, enhancing communications, increasing our engagement and response rates and making us healthier and better off.

Each part of the series will zoom in on a particular area or sector: healthcare, retail, financial services, education, charities, energy and utilities, to name just a few.

Sources:

1. Karlan, D., Zinman, J. Using Behavioral Economics to Help Individuals Reduce Debt in the United States, Poverty Action Lab/MIT, 2012

2. Bertrand, M., Morse, A. Information Disclosure, Cognitive Biases and Payday Borrowing, October 2009

3. Theos, B. et Al. (2016) An Evaluation of the Impacts of Two “Rules of Thumb” for Credit Card Revolvers. Urban Institute