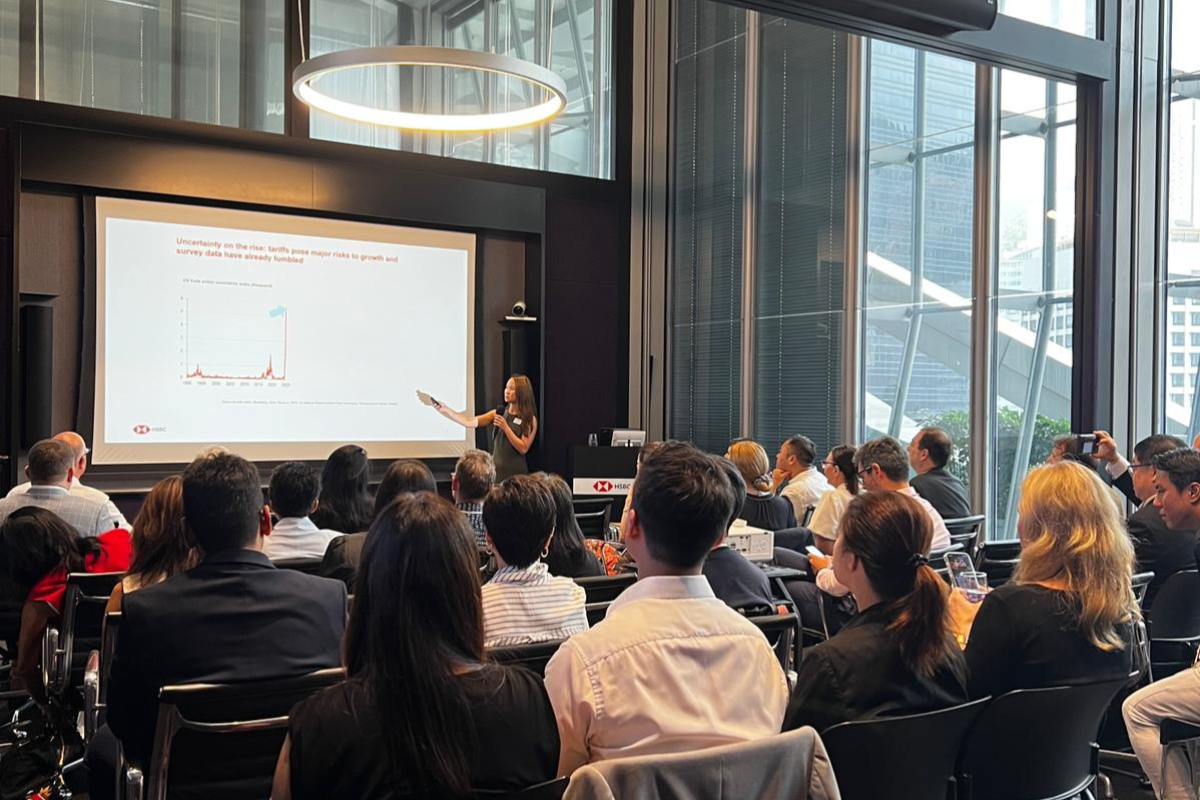

On 26 June, I had the great honour to present to the members of The Marketing Society at the HSBC main building in Hong Kong. The interactions with the audience were thought-provoking and prompted me to reflect more deeply on the new reality faced by global companies. As 52.7% of Members polled in the recent The Marketing Society pulse survey said that keeping up with change was top of their mind, we wanted to share the discussion more widely with our global community.

The New Trade Reality: Complexity and Unpredictability

The current global economic landscape is rife with complexity and unpredictability. The rollout of tariffs by the US has taken numerous twists and turns, creating a challenging environment for businesses across the globe and has disrupted the seamless flow of international business. In practice, this instability manifests itself in a variety of ways. For many businesses, the difficulty in accurately forecasting costs and revenues poses a significant problem. Budget projections, once reliant on historical data and predictable market conditions, now require constant revision to account for unforeseen changes in the global trade dynamic. This not only complicates financial planning but also places tremendous pressure on financial officers to stay abreast of political and economic developments across the multiple regions in which they operate.

According to the HSBC Global Trade Pulse Survey published at the end of May, two-thirds of respondents said they have already experienced cost increases due to tariff and trade uncertainty. Controlling expenses is now the top concern in supply chain management, regardless of location, industry, size or growth rate.

66% have already experienced cost increases due to tariff and trade uncertaint

77% thinking of ‘reshoring’, i.e. moving production to their home markets

90% plan to diversify their supplier base, expanding across regions to reduce exposure

Supply Chain Disruption: A Global Ripple Effect

Perhaps one of the most pressing challenges is the disruption to global supply chains. Economies and companies that participate in global trade and that are more internationally exposed are most at risk. A tangled web of interconnected suppliers means that the imposition of tariffs by one country can have a ripple effect, impacting the cost and availability of raw materials worldwide. Businesses must navigate logistical hurdles, delayed shipments, and increased costs - all while trying to ensure that their end products remain competitively priced. Many respondents in the HSBC Global Trade Pulse Survey are thinking of ‘reshoring’, i.e. moving production to their home markets (77%). At the same time, a growing number of companies are also pursuing ‘nearshoring’, meaning relocating production closer to their end customers. Close to 90% plan to diversify their supplier base, expanding across regions to reduce exposure. Rethinking global footprints is an increasingly critical business strategy.

As we enter the second half of the year, the US administration has signed trade deals with several countries, including Vietnam, Japan and the European Union. However, many questions remain. Multinational corporations now face a conundrum: how to maintain profitability and operational efficiency amidst such cost pressures?

Building Resilience: The Path Forward

To adapt to these challenges, businesses must cultivate agility and responsiveness. Executives are now required to adopt a proactive stance, which involves continuous monitoring of the geopolitical landscape and making swift decisions to mitigate potential risks. Decision makers would benefit greatly from investing in comprehensive scenario planning and risk management strategies that enable them to pivot quickly in reaction to international policy shifts. It is essential for each organisation to understand the impact of tariffs or export controls on their businesses, which varies widely by geography and product mix, operations footprint, and supply chains. Knowing your own business has never been more important than now.

Authored by Ines Lam, Economist, Global Research, HSBC Hong Kong